Partnership with Meridian Finance

Meridian Finance has integrated DIA oracles on the Base network to launch USDM, the algorithmic stablecoin backed by ETH.

Introducing Meridian Finance: A Decentralized Financial Powerhouse

Meridian Finance is a next-gen, non-custodial decentralized finance (DeFi) platform offering an array of financial services. With features like interest-free stablecoin loans, up to 50x leverage trading, and zero-slippage crypto swaps, Meridian Finance is redefining the DeFi landscape. Users can seamlessly trade whitelisted cryptocurrencies, secure over-collateralized loans using ETH, and accumulate valuable rewards by participating in the protocol.

Understanding USDM: The Base-native Stablecoin by Meridian

USDM by Meridian Finance is a cutting-edge, USD-pegged stablecoin. Designed for both stability and utility, USDM offers users the unique ability to redeem the stablecoin for Ethereum (ETH) at face value. By maintaining a minimum collateral ratio of 110%, Meridian’s USDM provides built-in price floor and ceiling mechanisms via arbitrage opportunities.

Successful Integration: DIA Oracles Empower Meridian’s USDM Stablecoin on Base Network

We are delighted to announce that Meridian has successfully integrated a custom ETH/USD DIA price oracle to launch the USDM algo-stablecoin on the Base network. The DIA oracle is used to approximate the fair value of the underlying collateral asset in order to guarantee collateralization and thereby the stability of the stablecoin through time.

The swift work from both teams is enabling USDM to be one of the first decentralized stablecoins live on the newly launched Ethereum L2 Base network. Learn more about Meridian in the Defillama dashboard.

The DIA price feed will serve as a cornerstone to our protocol's operations providing accurate, reliable and transparent data, enabling us to scale our operations with confidence. After working with DIA for over 18 months we are proud to have them as our trusted partner.TJFounder of Meridian Finance

A Multi-Source, Resilient Price Oracle: How it Works

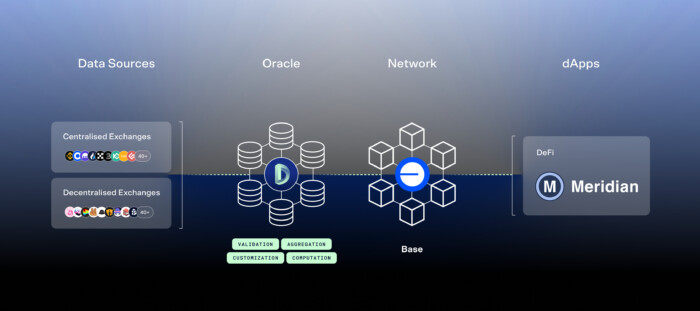

Our DIA oracle has been meticulously configured to offer exceptional resilience against volatile market conditions. It aggregates trade data for ETH tokens from over 20 top liquidity and high-volume exchanges, both decentralized (DEXs) and centralized (CEXs).

- High-Frequency Data Aggregation: The oracle operates on a 120-second trade aggregation window, providing real-time updates.

- Advanced Pricing Algorithm: Utilizes Moving Average Price with Interquartile Range (MAIR) to derive asset prices. Learn more.

- On-Chain Price Updates: Employs a deviation-based mechanism of 0.5%, updating the on-chain data whenever the ETH/USD price experiences a fluctuation greater than this value.

This robust oracle system was made possible through a Custom Delivery Request submitted by Meridian Finance in the DIA Forum, under the proposal CDR #058: Meridian Finance | Price Feed on Base Network.