the biggest collection ofcustom token price feeds

Build new DeFi dApps leveraging DIA’s price oracles for 3,000+ tokens, transparently sourced from high-volumes CEXs and DEXs.

Why Do We Need DIA PRICE ORACLES?

Introducing DIA Token Price Feeds

Access DIA’s catalog of 3,000+ cryptocurrencies, from blue-chip tokens to long-tail assets.

Feeds are constructed using real-time trade data from high-volume DEXs and CEXs, ensuring total transparency throughout the process.

Transform raw trade data into reliable feeds using methodologies from outlier filtering to advanced pricing. DIA supports all use cases.

DIA builds market prices for global or chain-specific tokens and makes them available via API or oracle in any of the integrated 35+chains.

what do builders say?

One of the great things about DIA is they're basically helping us be a pioneer in what we can take as collateral by providing us really safe, secure and

accurate cross-chain price feeds.Colton ConleyPrime Co-Founder

Reliable data is the lifeblood of the on-chain ecosystem — without it, some of the most significant use cases couldn’t exist. We’re super excited to collaborate with DIA to make high-quality price feeds available for devs building on Base.Jesse PollakBase Lead

It is with utmost delight that I announce the integration of DIA oracles into the Dopex platform. DIA has been a proven and trusted partner to multiple Arbitrum protocols and we are pleased to have their support.Nutoro D. ChutoroDopex Core-Team

A TRANSPARENT DATA JOURNEY

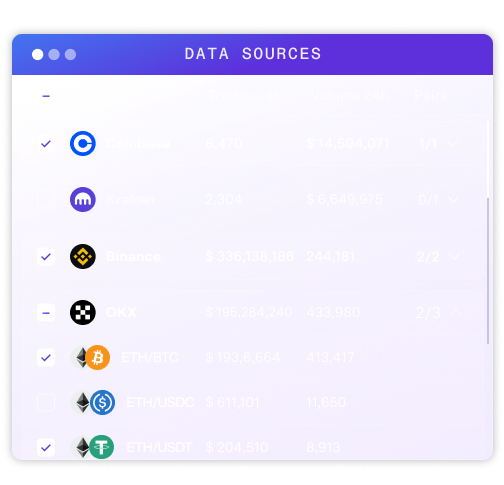

Fetching trade data directly from 90+ exchanges

DIA scrapes data from markets, bypassing opaque 3rd-party providers and ensuring 100% source transparency.

By tapping into a vast array of sources, DIA provides unparalleled customizability and asset coverage.

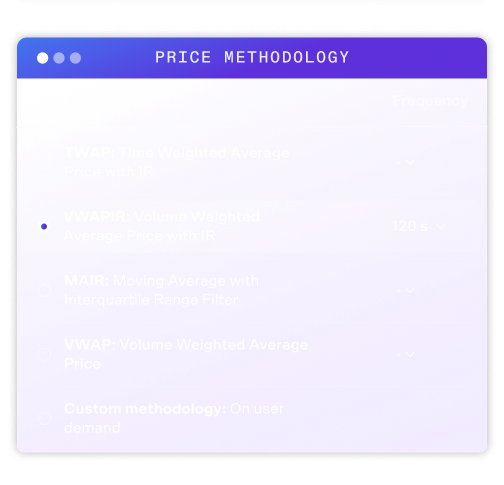

Applying customizable methodologies

DIA employs custom computational methodologies to process raw trade data into reliable feeds.

From outlier filters to on-demand sophisticated pricing techniques, DIA can cater to any use-case requirement.

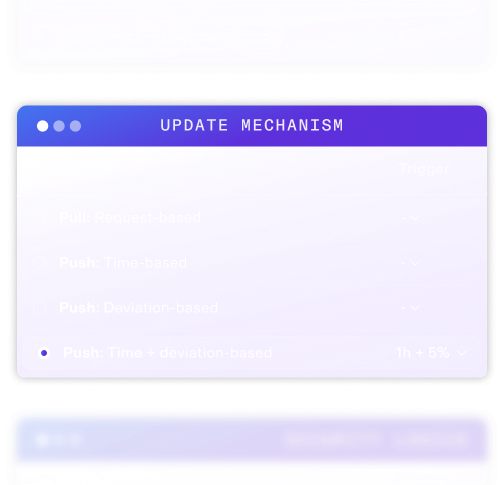

Delivering feeds off-chain and on 35+ chains

DIA deploys bespoke feeds for each customer via API or GraphQL and on-chain via oracle on 35+ chains.

APIs and oracles can be configured with custom update triggers and frequencies, enhancing their usability.

unparalleled customization

DIA’s direct and granular data sourcing enables the most complete customization to build high-confidence oracles for any token.

supporting 3,000+ tokens

INTEGRATION EXAMPLES

Powering next-genweb3 products

Expand the capabilities of your DeFi application by unlocking oracle dependant use cases

BUILD DEFI DAPPS WITH

TRANSPARENT PRICE ORACLES

Ready to scale your dApp with transparent, customizable oracles?