What is a Blockchain Oracle: Understanding Their Role, Types, and Impact

Dive deep into the world of blockchain oracles. This comprehensive guide explores their essential function in bridging blockchains with the external world, the various types available, their implications for the DeFi landscape, and more.

What Are Blockchain Oracles or Crypto Oracles?

Blockchain oracles serve as bridges between the off-chain world and on-chain protocols. They provide smart contracts with external data, enabling them to create more complex and useful use cases while ensuring the decentralized applications operate optimally. Understanding their role is essential to grasp the potential of blockchain technology fully.

What is an oracle in the blockchain context?

An oracle, in the context of blockchain, refers to a third-party information source that provides data to smart contracts. Smart contracts, inherently, cannot access real-world information outside their network. Oracles bridge this gap.

Why are oracles crucial?

In the absence of oracles, smart contracts would be limited in their functionality as they’d lack real-world data. Oracles expand the use cases for smart contracts by feeding them timely and accurate data.

Trustworthiness

Relying on a single data source might introduce centralized points of failure. Fetching data from multiple sources is critical to ensure the information’s accuracy, integrity and decreased risk of manipulation

Challenges with Oracles

Oracles, particularly ones reliant on single sources, can be vulnerable to security threats. Incorrect or manipulated data can disrupt the functionality of a smart contract.

How do they work?

Oracles fetch data, process it if necessary, and then relay it to the smart contract on the blockchain. The smart contract then executes based on this data.

Oracle Examples

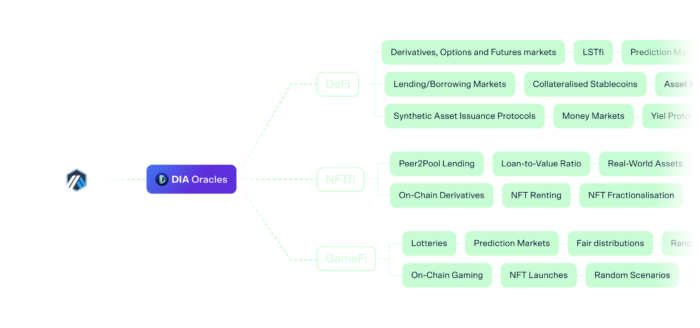

- Price Feed Oracle: Decentralized finance (DeFi) platforms use price oracles to obtain real-time market price cryptocurrencies and use them to execute smart contract transactions in lending and borrowing, opton.

- Randomness oracle: Gaming Finance (GameFi) protocols use randomly generated numbers on-chain to power lotteries, prediction markets, NFT launches and other on-chain use cases.

- Weather-based Smart Contract: A crop insurance smart contract that pays out if there’s no rain for 30 days might rely on a weather oracle for accurate data.

Popular Oracle Solutions

- DIA: DIA is a cross-chain data and oracle platform, specializing in the sourcing and delivery of fully transparent, customizable, and resilient data feeds, setting a new paradigm for oracles.

- Chainlink: Chainlink is a decentralized blockchain oracle network. The network is intended to be used to facilitate the transfer of tamper-proof data from off-chain sources to on-chain smart contracts.

- Band Protocol: Band Protocol is a cross-chain data oracle platform with the aspiration to build high-quality suites of web3 development products.

- Pyth: Pyth Network is an oracle that publishes financial market data to multiple blockchains. Pyth market data is contributed by over 80 3rd-party publishers.

- Uma: UMA is an optimistic oracle and dispute arbitration system that securely allows for arbitrary types of data to be brought on-chain.

Future of Oracles

As blockchain technology evolves, the role of oracles will likely expand, with more sophisticated and decentralized solutions emerging to cater to the growing demands of the decentralized world.

How Do Different Types of Oracles Vary in their Functionality and Application?

Oracles can be broadly categorized based on their data sources, trustworthiness, and operational methodologies. To gain a deeper understanding, let’s dissect the distinct types of oracles and their inherent features:

1. First-party vs Third-party Oracles:

- Third-party Oracles: These oracles harness multiple premium data providers to aggregate information. This aggregated data is then relayed on-chain via a network of nodes. However, they come with a dependency on these providers for data consistency and availability. Notably, some providers might be non-transparent about their data sources and methodologies.

- First-party Oracles: These oracles procure data straight from its origin, process it, and then release it on-chain. They offer numerous benefits over third-party oracles, such as enhanced transparency, customization, and a wider spectrum of asset coverage.

2. Push-Oracles vs Pull-Oracles:

- Push-Oracles: They autonomously publish data on-chain based on specific predefined triggers, be it a time interval or a deviation from the previously reported value.

- Pull-Oracles: These oracles publish data on-chain whenever requested by a dApp (via smart contract, API, etc), making them more cost-efficient, as oracle update transactions are executed and gas tokens are used only when strictly required. These oracle types only work in some use cases.

3. On-chain vs Hybrid Oracles:

- On-Chain Oracles: Operating entirely on-chain, these oracles can only access data existing within the blockchain. Their scope is somewhat limited, especially in terms of price feeds, which might be restricted to assets with substantial trades on decentralized exchanges (DEXs).

- Hybrid Oracles: A blend of on-chain and off-chain operations, these oracles collect data from both realms. Once aggregated, this data is published on-chain. Owing to their access to a plethora of data sources, including Centralized Exchanges (CEXs), they boast a much broader capability.

4. Public vs Private Oracles:

- Public Oracles: Representing open-source oracle contracts, these provide specific data feeds that anyone can access. Once deployed, they become immutable and possess pre-defined configurations. Their upkeep, predominantly involving the funding for transaction fees, falls upon the community. They are often rolled out as community goods or for demonstrative purposes.

- Private Oracles: Tailored for specific clients, these oracles are only accessible to designated users. They come with custom configurations and offer exclusive data feeds. Maintenance responsibility, especially concerning gas fees, rests with the client. Furthermore, they can be edited, upgraded, or tweaked to cater to the evolving needs of their dedicated application.

In summary, the multifaceted world of oracles is shaped by their sources, operational methods, and accessibility, each type bringing its unique strengths and challenges to the decentralized ecosystem.

How do Blockchain Oracles Impact Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) stands as a paramount manifestation of blockchain technology, and oracles are its unsung heroes, underpinning its every move. Let’s delve deeper into the pivotal role of oracles in the DeFi universe:

1. Pioneering DeFi Use Cases: At the heart of many DeFi applications, oracles deliver real-time price feeds, which are instrumental for tasks like determining loan ratios, activating liquidations, and valuing assets. DeFi, in its current form, would be unimaginable without oracles. Here are some of the widespread applications made feasible by oracles:

- Lending and Borrowing: Empowering users to employ various tokens as collateral to secure loans.

- Options and Futures: Providing traders the tools to hedge or amplify their positions.

- On-Chain Asset Management: Automating portfolio strategies directly on-chain.

- Algorithmic Stablecoins: Introducing stablecoins supported by digital or tangible assets, such as real estate.

- Perpetual Decentralized Exchanges: Ensuring fluid trades with minimal slippage.

- Synthetic Assets: Crafting digital representations of real-world assets like stocks.

- Prediction Markets: Platforms for trading predictions on the outcomes of diverse events. … and the list goes on.

2. Bolstered Security: As we witness the advent of novel asset types beyond traditional cryptocurrencies, like liquid-staked tokens, the data requirements around these “mirror” tokens grow. Certain oracles, for instance, offer feeds reflecting the collateral ratios of these assets, thus infusing an added dimension of security and transparency when incorporating LSTs into DeFi frameworks. Chainlink’s Proof of Reserve feeds stands out as an exemplar, providing accurate and timely oversight of on-chain reserve assets.

3. Enabling Cross-Chain Operations: In the age of multi-chain DeFi ecosystems, oracles like DIA are pioneering by crafting price feeds for native tokens and proliferating them across multiple chains. This not only enhances a token’s utility across various blockchains but also fosters frictionless cross-chain interoperatibility in DeFi initiatives.

4. The Dawn of Innovation: The accessibility to trustworthy off-chain information via oracles has catalyzed the birth of avant-garde financial tools and services within the DeFi realm and beyond. This ripple effect has even given rise to fresh Web3 sectors such as GameFi and NFTfi, made possible by new oracle archetypes, including NFT floor price oracles and randomness oracles.

In summation, oracles are the lifelines that bridge the gap between off-chain reality and on-chain DeFi functionality, facilitating innovations that continue to reshape the financial landscape.

How do Blockchain Oracles Ensure Data Accuracy?

Ensuring the accuracy and reliability of data in a decentralized environment is a primary concern for blockchain oracles. Here’s a deeper dive into the mechanisms ensuring data accuracy:

- Multiple Data Sources: oracles often fetch data from various sources. This multiple sourcing reduces the risk of relying on a single, potentially faulty, data source.

- Consensus Mechanisms: Before relaying the data to the smart contract, some oracles might have a consensus mechanism where multiple nodes must agree upon the data’s accuracy.

- Reputation Systems: Some oracle solutions incorporate reputation systems, especially ones reliant on 3rd party premium data providers. Oracles that consistently provide accurate data get higher scores, incentivizing truthful reporting.

- Economic Incentives: By attaching rewards (and penalties) to the provision of accurate data, oracles can be financially incentivized to report truthfully.

- Data Verification: Before being relayed to the blockchain, some oracle systems verify the data’s authenticity using cryptographic proofs or other validation methods such as zero-knowledge proofs.

- Data Filtering: Multiple pieces of data can be aggregated to form an averaged or median value, reducing the impact of outliers or incorrect data.

- Stake and Slash Mechanisms: Some systems require oracles to stake funds. If they’re found to be reporting inaccurately, their staked funds might be slashed.

What Security Measures are in Place for Oracles in Crypto?

Ensuring the security of blockchain oracles is crucial, considering their integral function in the execution of smart contracts. Let’s delve into the intricate security frameworks that underpin these oracles:

- Fallback Mechanisms: Preparedness is key. In instances of unforeseen failures or potential attacks, oracles often alternate data sources to ensure an uninterrupted flow of service. For instance, in a price feed, if one or more of the sources do not meet the criteria to be a reliable source any more, the oracle could switch to single exchange source that gathers the deepest liquidity for that token.

- Monitoring and Alerts: Vigilance is maintained through continuous oversight of oracle operations. This constant surveillance ensures that any irregularities are swiftly identified. In practical terms, this might involve an alert system that sends notifications when the price of a token on a particular exchange starkly contrasts with its value on other CEXs and DEXs. This can allow oracle users to take informed action with their oracles.

- Circuit Breakers: Automated responses can be pivotal in certain scenarios, particularly during attempts at market manipulation by malicious entities. By activating these circuit breakers, the influence of such nefarious activities can be contained, preventing them from permeating protocols that rely on oracle data.

- Data Cross-Checking: A robust validation process often involves juxtaposing oracle data with other internal or external benchmarks. As a practical example, this could entail leveraging multiple third-party data sources as reference points, ensuring the accuracy and reliability of the oracle’s data output.

In essence, the complex web of security measures enveloping oracles ensures they remain resilient, reliable, and most importantly, trustworthy in the decentralized ecosystem.

How Can One Determine the Reliability of a Blockchain Oracle?

Determining the reliability of a blockchain oracle is paramount given their influential role in ensuring accurate and timely data delivery within blockchain systems. Here’s a comprehensive guideline to assist in evaluating their trustworthiness:

- Track Record: An oracle’s historical performance can be an insightful barometer. Has the oracle been consistent in furnishing precise and punctual data? A history of accuracy can instill confidence.

- Number of User Integrations: Examine the breadth of adoption. How many users have integrated this particular oracle into their operational systems and applications? Widespread usage often suggests reliability.

- Diversity of Sources: A robust oracle platform will typically boast a diverse array of data sources. This diversity can enhance accuracy and reduce reliance on any single data point.

- Transparency: It’s imperative that the oracle maintains clarity regarding its data sources and computation methodologies. Can you easily discern where the data is sourced from and how it’s processed?

- Security Measures: A reliable oracle won’t just talk about security; it will have tangible mechanisms in place. Does the oracle incorporate robust security protocols, such as continuous monitoring, fallback systems, and the like, as previously discussed?

- Feedback from the Community: The collective wisdom of the blockchain community can be a goldmine of information. Are there testimonials, endorsements, or even cautions from respected community figures? An oracle’s reputation within the community can be a telling sign of its reliability.

In conclusion, by diligently assessing these facets, one can paint a clearer picture of an oracle’s reliability, ensuring that the data they rely on is both accurate and secure.

Why is There a Need for Multiple Crypto Oracles in DeFi?

Since the emergence of the inaugural oracle providers, the Web3 realm has witnessed exponential growth and a broadening array of oracle services. Here’s why this diversification is beneficial for the Web3 ecosystem:

- Use-case Specialization: Certain oracle providers, influenced by their specific architecture, are designed to cater to particular dApp requirements. This can range from offering varying degrees of customization, update speeds, and cost structures, among other factors.

- Service Specialization: Oracles differ in their ability to serve diverse Web3 data requirements, both on-chain and off-chain. For instance, while some oracles focus on delivering accurate pricing information for niche assets, others excel at on-chain/off-chain automation or distributed random number generation.

- Ecosystem Specialization: Given the intensive technological demands of integrating oracles into various blockchain platforms, some oracles are more suited to specific ecosystems. As a result, we’re seeing oracles that specialize in different platforms like Substrate-based, IBC-based, or EVM-based environments.

- Fair Competition: A plurality of oracle providers ensures a healthier, more competitive Web3 landscape. Sole reliance on a single dominant oracle, even if it’s decentralized and reputable, introduces a potential single point of failure. Moreover, a monopoly could lead to negative repercussions like skewed service pricing, user security issues, and a stagnation in innovative developments.

In essence, the continued proliferation and specialization of oracle providers enhance the robustness, resilience, and vibrancy of the Web3 space.

FAQ

Oracles provide a bridge between blockchains and the external world, fetching, validating, and feeding essential external data to smart contracts.

At the heart of many DeFi applications, oracles deliver real-time price feeds, which are instrumental for tasks like determining loan ratios, activating liquidations, and valuing assets.

There are first-party and third-party oracles, push and pull-based oracles, on-chain and hybrid oracles and public and private oracles.

The Web3 ecosystem benefits from multiple oracles due to specialized use-cases, diverse service offerings, and ecosystem-specific solutions. This variety promotes fair competition, preventing over-reliance on a single provider and fostering innovation, ensuring a robust and dynamic Web3 landscape.