Partnership with zkFinance

zkFinance has officially integrated DIA oracles on zkFinance to power the deployment of new money markets based on high-quality and reliable asset price feeds.

Introducing zkFinance

zkFinance is a one-stop DeFi solution that leverages zkSync technology to offer cheaper, faster, and more secure transactions. It provides an immutable money market on-chain through zero-knowledge proofs, which enhances security and privacy. Users can trade, stake, and pool various tokens. The platform is designed to be user-friendly and accessible to everyone, regardless of their technical expertise or financial status.

We are delighted to announce that zkFinance has officially integrated DIA oracles into its platform on zkSync. zkFinance users can now benefit from reliable and accurate price feeds for different digital assets. The oracle, customized to meet the specific requirements of the dApp, ensure optimal performance. The incorporation of DIA oracles empowers zkFinance to safely deploy new money markets based on high-quality and highly reliable asset price feeds, enhancing the overall functionality and reliability of zkFinance and providing users with a seamless DeFi experience.

“Having a reliable stream of prices is of utmost importance for zkFinance as this gives confidence to our users that prices are accurate and can’t be manipulated. As a result, users can be highly confident that the money markets accurately reflect market conditions. This is another milestone in our path to provide a high quality product based in zkSync. We are truly excited to work together with DIA Oracles”Pedro Isaac LopezCo-Founder & COO

The Crucial Role of Price Oracles in On-Chain Money Markets

Price oracles play a pivotal role in on-chain money markets, primarily due to their contribution to the accurate valuation of assets. These markets involve a diverse range of assets, each with its unique value. Price oracles offer real-time, reliable market prices for these assets, enabling their precise valuation. This is particularly vital in lending and borrowing platforms within the DeFi ecosystem, where loans are collateralized by these assets.

Without the accurate price information provided by oracles, assessing the value of collateral correctly becomes challenging, potentially leading to imbalances in the lending and borrowing process. Hence, price oracles are fundamental in maintaining the integrity and smooth operation of on-chain money markets.

zkSync’s DIA Custom Oracle: Ensuring Accurate Asset Valuation

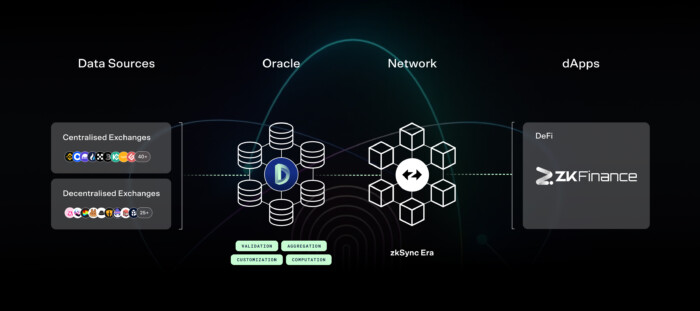

DIA has developed a customized price oracle for zkFinance, configured to provide price data for several assets, including USDC, USDT, BUSD, DAI, ETH and more. The feeds are built by utilising market data from 80+ high-volume centralised and decentralised exchanges. The price calculation methodology employed is the Moving Average Price with Interquartile Range (MAIR), which aggregates three resulting prices using a volume-weighted average.

To ensure the accuracy and relevance of the data, a 1% deviation threshold for updates trigger has been set for each asset. If the price of an asset deviates by more than 1% from the previous value, the oracle triggers an update. In the absence of any deviation-based updates, the feed is refreshed every 24 hours.

A Transparent, Custom Oracle Delivery

DIA deployed a dedicated and tailor-made oracle to supply zkFinance with the most optimal price feeds. The oracle is designed with custom parameters, such as source markets, price determination methodology, update mechanism, etc. These configurations facilitate the zkFinance team with the most suitable oracle for its unique money market use case.

These requirements were transferred to DIA by submitting a DIA Custom Delivery Request (CDR) via the DIA Forum which is publicly available to everyone.