Partnership with Relative Finance

Revolutionizing decentralized derivatives: introducing NFTs to Relative Finance’s suite of SocialFi products through the partnership and integration with DIA’s xFloor oracle product.

Introducing Relative Finance

Relative Finance is building cross-sector dApps for derivatives and skill-based wagering across SocialFi, DeFi, and GameFi. Their first product offering provides market participants with exposure to the ‘relative’ strength between two assets through the creation of Relative Strength Derivatives (RSDs) in the form of a binary wager. RSDs provide participants with the ability to speculate on the difference in performance between two assets, rather than the absolute performance of a single asset.

Adding support for NFTs with DIA oracles

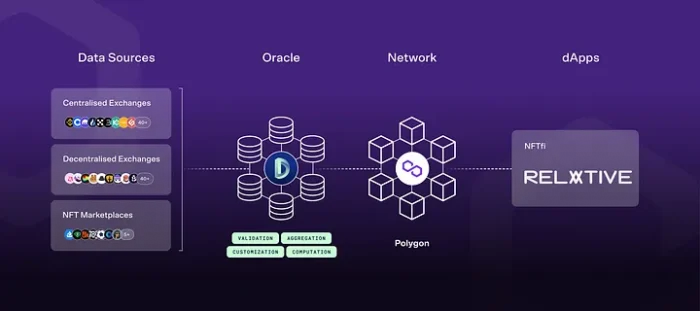

Relative Finance has successfully integrated a custom DIA xFloor oracle. The oracle provides Relative with fully customised real-time price feeds for a variety of NFT collections. DIA xFloor leverages trade data from multiple markets, applying customizable pricing methodologies that suit the needs of Relative Finance.

Relative Finance’s “Social Wagering”, provides participants with the ability to speculate on the difference in performance between two assets. Up until now, the product only offered support for fungible tokens and real-world assets. The integration will introduce a new asset class into Relative’s existing product portfolio: Non-Fungible Tokens (NFTs). With the addition of NFTs, Relative Finance is further diversifying the betting opportunities available to its users, enhancing the versatility of its platform.

Overcoming the challenge of NFTs’ low liquidity

Among the NFT collections integrated into the platform are popular names like Milady, BAYC, MAYC, Clone X, Cool Cats, Pudgy Penguins, Azuki, and Valhalla. Although the integration faced challenges due to the low trade frequency of some collections and potential wash trading risks, DIA’s moving average floor price methodology and Interquartile Range outlier detection system have helped mitigate these issues.

This partnership opens up a new avenue of betting opportunities for Relative Finance’s users. By incorporating NFTs into their asset class offerings, they are pushing the boundaries of the decentralized derivatives market and strengthening their position in the space.

“We had some concerns about low volatility and lack of trades, which is why we hadn’t integrated NFTs onto our platform yet. NFTs, being a more illiquid asset class than the crypto and real-world assets currently on our platform, necessitated adjustments to our approach. After testing with DIA’s highly configurable data platform, we decided to use a moving average floor price duration of 3 days and a floor window of 1 day for determining price feeds. This turned out to work great for our platform’s unique needs. We are looking forward to continuing working with DIA in future integrations.”Core contributor