Partnership with Orbiter One

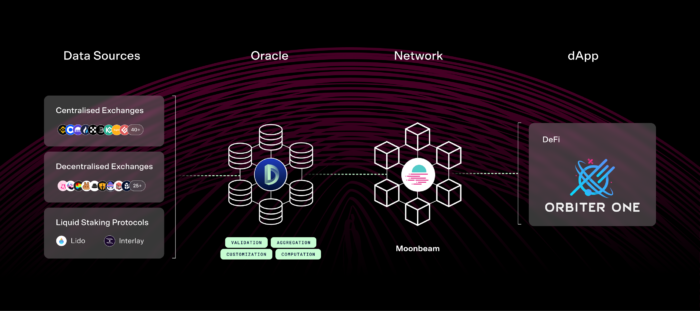

We are excited to announce that Orbiter One has officially integrated DIA’s transparent price oracle to list 15+ tokens and LSDs in its cross-chain, peer-to-peer lending protocol on Moonbeam.

Introducing Orbiter One

Orbiter One is a decentralized peer-2-peer lending and borrowing platform focused on cross-chain interoperability. Being deployed on the Polkadot parachains Moonriver and Moonbeam, users on Orbiter One can make use of the power of cross-chain EVM compatibility to get the most out of their lending experience.

Orbiter One users are able to use over 14 assets for lending and borrowing on the Moonriver and Moonbeam blockchains, all of which DIA will provide the pricing oracles. Special attention is given to the Liquid Staking Derivatives (LSD), which will play a big role in the Orbiter One ecosystem by enabling their users the full liquidity over their liquid-staked assets.

Orbiter One Join Forces with DIA

We are thrilled to announce a new collaboration with Orbiter One to provide the protocol with a price oracle for its decentralized lending solution on Moonriver and Moonbeam. The oracle will allow Orbiter One to list a variety of tokens as well as Liquid Staked Derivatives (LSDs) on its platform, based on high-quality, transparent asset price data. The oracle integration will boost the utility of the Dotsama native lending and borrowing platform.

Without data platforms, lending protocols like Orbiter One simply cannot work. We are excited to be partnered with DIA in particular because they offer a very large variety of price feeds and they swiftly develop new ones per market demand.Yuriу SigalovOrbiter One CEO

Price Oracles for Any Asset Type

In order to support a selection of tokens and LSDs in its decentralised lending platform, Orbiter One requires accurate and reliable price information of those assets on-chain. Hence, the oracle contains price feed two asset types:

Market Price Feeds for Standard Tokens

On the one hand, the deployed oracle is importing the market price information for regular digital assets, including wMOVR, WBTC, ETH, KSM, MAI, and more. The price feeds of these assets are calculated by leveraging granular, trade data, sourced from multiple markets and applying a Moving Average Price with Interquartile Range (MAIR) methodology.

Fair-Value Price Feeds for Liquid Staked Derivatives

On the other hand, the oracle also contains fair-value price feeds for LSDs kBTC and wstKSM. Since LSDs are infrequently traded in exchanges, utilising the market value of the assets would be very risky and highly susceptible to market manipulations. Therefore, DIA determines the fair value of the assets by performing a collateral-ratio check on issuing protocol (i.e Lido or Interlay). This results in a risk-minimizing and transparent feed to integrate into lending protocols.

With liquid staking products rapidly growing, offering support for these types of assets in DeFi is necessary, and DIA as well as Orbiter One are focussing on bridging this gap. DIA is enabling users of the Orbiter One platform to use their LSD tokens as collateral in a transparent and safe manner, which will allow them to access the largest collateral variety on Dotsama.

We are excited to help Orbiter One enable the largest collateral variety on the market by 2023. The space is in dire need of easy-to-use cross-chain interoperability, and Orbiter One fills that gap almost seamlessly. Together with their support for liquid-staked assets, we see a bright future for their platform, and we are excited to help them enable their full potential!Michael WeberDIA Association President

Transparent and Fully Customizable Delivery

DIA deployed a dedicated and tailor-made smart contract oracle to supply the most suitable price feeds for Orbiter One. Besides the feed requirements laid out above, the oracle was set up with a custom update trigger of a 0.5% deviation threshold for each asset.

All these tailor-made configurations facilitate Orbiter One with the most suitable oracle for its needs. These requirements were transferred to DIA by submitting a DIA Custom Delivery Request (CDR) via the DIA Forum which is publicly available to everyone.