Hello BEVM: DIA Integrates with the Bitcoin Layer-2 EVM

DIA has integrated its library of price feeds for 20k+ assets, including Bitcoin ordinals, to fuel the dApp development and growth in the BEVM ecosystem.

Update: BEVM Network Goes Mainnet with DIA Oracles

We’re excited to announce the integration of DIA oracles with the BEVM mainnet! This collaboration opens up endless possibilities for DeFi developers within Bitcoin’s Layer 2 ecosystem. Access comprehensive price feeds, including Bitcoin native assets like ORDI and SATS, to build cutting-edge decentralized applications.

Access the oracles in the smart contracts below:

- BEVM Testnet Oracle address: 0x719108DC653CC3a9055ab8d9018c5D7924912631

- BEVM MainnetOracle address: 0x9a9a5113b853b394E9BA5FdB7e72bC5797C85191

What is the BEVM network?

BEVM is the first fully decentralized EVM-compatible Bitcoin L2 that uses BTC as Gas. It allows all dApps running in the Ethereum ecosystem to operate on Bitcoin L2. BEVM is creating a cross-chain interaction Layer Through Bitcoin light nodes and a combined POS consensus of Taproot threshold contracts to realize decentralized interaction between Bitcoin and BEVM.

BEVM synchronizes Bitcoin block headers and cross-chain transaction Merkle proofs to ensure data accuracy and network determinism. BEVM utilizes Taproot technology and POS consensus nodes for secure, decentralized handling of asset and data cross-chain transactions between BEVM and the Bitcoin mainnet.

DIA Brings Oracles to the BEVM Network

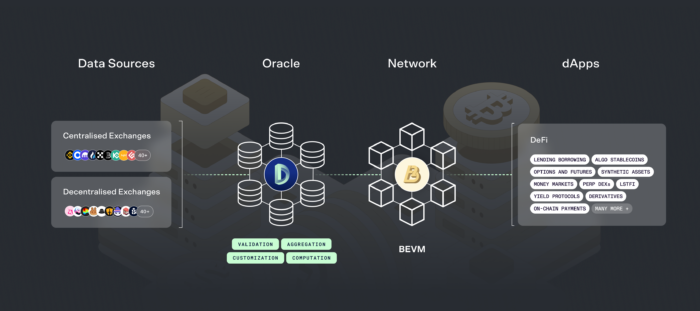

We are thrilled to announce that DIA has integrated its library of price feeds to fuel the development and growth of use cases and dApp in the BEVM ecosystem. DIA is renowned for its fully transparent and customizable price feed oracles, encompassing an array of over 20,000 assets.

This integration with BEVM means that developers and builders can now access reliable and extensive data feeds for a vast range of assets including cryptocurrencies, NFTs and Liquid Staked Tokens – LSTs, directly on the Bitcoin ecosystem.

Oracle Support for Bitcoin Ordinals

As Bitcoin ordinals, a novel and innovative asset class within the Bitcoin network, grow in popularity and adoption, the integration of DIA by BEVM is timely.

Thanks to DIA’s unique architecture, which scrapes trade data from both CEXs and DEXs, it can construct price oracles for any asset traded on these platforms. Consequently, DIA now supports Bitcoin ordinals, adding this new category to its library of price feeds.

Explore some of the price feeds in the DIA App below:

DIA is an excellent Oracle, which is the first to support Bitcoin L2. BEVM and DIA Oracle will work together to build the future of #BTClayer2 derivatives. We believe that through DIA's vast data sources, BEVM can enjoy superior, immediate and accurate price feeding.JhonBEVM Builder

Robust Oracles, Built for Customizability and Transparency

DIA constructs its data feed oracles through a comprehensive three-step process: Collection, Computation, and Publication. Initially, it collects extensive market data from various on-chain and off-chain sources, including centralized and decentralized exchanges. This data is then processed using transparent and customizable computational methodologies, transforming raw trade data into reliable feeds tailored to specific needs.

Finally, these feeds are published onto the blockchain via oracle smart contracts, supported by a decentralized network of nodes. These oracles can be configured as push-based, to deliver the most up-to-date information, or pull-based, to save unnecessary gas costs and deliver updates on a request basis only.

Potential Use Cases Powered by Price Oracles

Fusing DIA’s oracles with BEVM opens doors to myriad new applications and use cases on the BEVM network. Each of these applications, once limited in the Bitcoin ecosystem, can now be explored and developed with greater depth and sophistication. These applications, powered by price oracles include:

- Advanced financial instruments like options, futures, and derivatives

- Prediction markets offering insights into future events

- Decentralized platforms for lending and borrowing

- Creation of collateralized stablecoins

- Issuance of synthetic assets

- Dynamic money markets

- Yield protocols offering new investment opportunities

- On-chain payment solutions

Impact on the Bitcoin Ecosystem

The integration of DIA with BEVM represents a pivotal moment. BEVM, enabling Ethereum ecosystem DApps to operate seamlessly on Bitcoin L2, combined with DIA’s advanced oracles, bridges a critical gap in Web3. This union allows dApps to access and utilize external data, paving the way for more complex and practical applications within the Bitcoin ecosystem.

By bringing together these technologies we are heralding a new wave of sophisticated, useful applications for Web3 users that leverage the best of both Ethereum’s versatility and Bitcoin’s robustness and decentralization.