Unlock DeFi on Bitcoin with DIA’s BRC-20 Oracles

DIA oracles support BRC-20, powering a new wave of DeFi applications on Bitcoin Layer-2s and beyond.

Any BRC-20 Price Oracle Can Be Supported

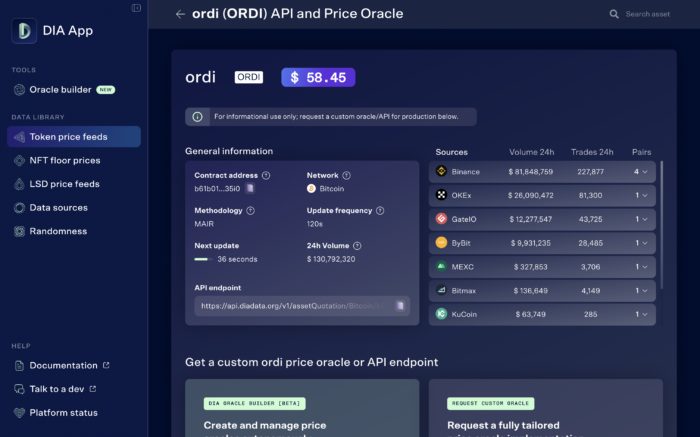

DIA boasts the broadest library of price feeds in the market including BRC-20 tokens and the ability to support upcoming ones quickly. But how does that work?

DIA’s novel first-party approach, consisting of fetching market data directly off of exchanges’ smart contracts, enables the creation of price feeds for any assets traded in DIA’s integrated 90+ sources. DIA already supports popular BRC-20 assets such as ORDI, SATS and many more.

Moreover, for any future BRC-20 token listed in those markets, DIA will also be able to support it automatically. DIA also integrates DEXs native to Bitcoin L2s in demand and in a timely fashion, for further coverage of assets within the Bitcoin ecosystem.

Enhanced Oracle Security via Customization

Less common assets or ‘long-tail assets’ like BRC-20 tokens, vary greatly in liquidity, trading volume, and the reliability of their data sources. Traditional one-size-fits-all oracle solutions using third-party providers often fall short due to their lack of transparency. This forces dApps to blindly trust these data feeds without clearly understanding their origins or methodologies.

In stark contrast, DIA offers bespoke pricing solutions for each asset, emphasizing full transparency in methodologies and data sources. This approach enables a deep dive into the specific market conditions of each asset, leading to the creation of robust and reliable oracle solutions tailored to individual needs.

For example, in a perpetual trading protocol, the need for high-frequency updates (e.g., every 10 seconds) is critical and easily applied for constantly traded blue-chip assets. However, a lower update frequency is often preferable in a lending-borrowing protocol with a broader range of assets like BRC-20 tokens. This is particularly important for assets with lower trading volumes and liquidity, where a high-frequency oracle update can pose risks, allowing for potential price manipulation within short timeframes.

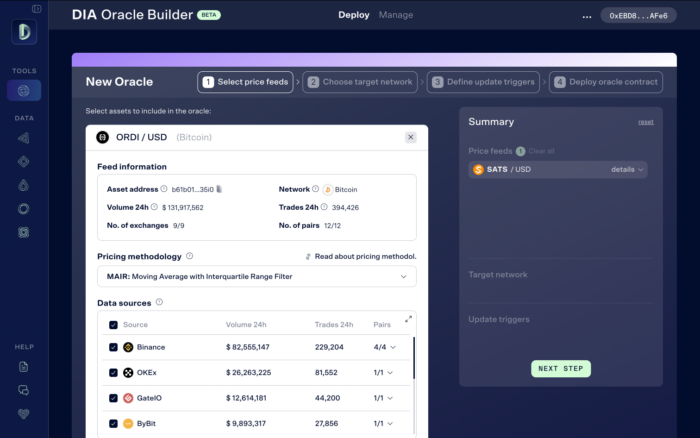

DIA’s solution? Adjust the frequency of updates and how much data is collected, creating a more stable and reliable feed suited to each application’s needs. For instance, updating every 2 minutes instead of every 10 seconds can provide a fuller picture of an asset’s value, reducing the risk of manipulation.

Proven Infrastructure and Advanced Features

DIA has been providing top DeFi protocols with price oracles for long-tail assets. To effectively and securely achieve this, DIA has developed a solid oracle infrastructure consisting of:

- Monitoring of sources (liquidity, trades and volume levels)

- Logics for dynamic data source selections

- Advanced pricing filters to detect outliers

- Price simulation and backtesting strategies

- Feed monitoring analytics dashboard

- Battle-tested requirements for reliable data sourcing

- Many more

Driving Bitcoin Interoperability

DIA’s oracles currently broadcast BRC-20 token price feeds to EVM and non-EVM Bitcoin Layer-2s and a list of integrated 50+ blockchains, fostering cross-chain DeFi interactions.

Moreover, DIA can quickly integrate with new chains on demand thanks to its chain-agnostic architecture, allowing new up-and-coming ecosystems like the Bitcoin L2s to thrive with new DeFi dApp deployments, powered by DIA oracles.

Enabling Advanced DeFi Uses Cases for BRC-20 Tokens

DIA Oracles break away from the “one size fits all” model with fully customizable configuration settings, such as sources, and processing but also update mechanisms (pull or push-based oracles), enabling developers to innovate with complex financial instruments:

Collateralized Stablecoins

With DIA’s oracle services, developers can now create stablecoins pegged to real-world assets or cryptocurrencies, collateralized by BRC-20 tokens. This opens avenues for stable, trustable currencies on the Bitcoin network, enhancing trade and value storage without leaving the security and familiarity of Bitcoin.

On-Chain Vaults

Leverage DIA’s oracles to build on-chain vaults that automate yield-generating strategies with BRC-20 tokens. These vaults can dynamically adjust to market conditions based on the data fed by DIA oracles, optimizing returns for participants and introducing a new layer of financial products on Bitcoin Layer-2s.

Facilitating Lending and Borrowing

DIA oracles enable the creation of lending platforms using BRC-20 tokens as collateral, opening up new liquidity opportunities for user capital that were idle until now. This will be especially interesting to unlock capital efficiency for millions of Bitcoin network users.

Start Building on Bitcoin with BRC-20 Oracles

Ready to build the next big thing in Bitcoin DeFi? Connect with our team on Telegram to explore how DIA’s oracle services can support your BRC-20 project.