2023 in Review: Product Developments

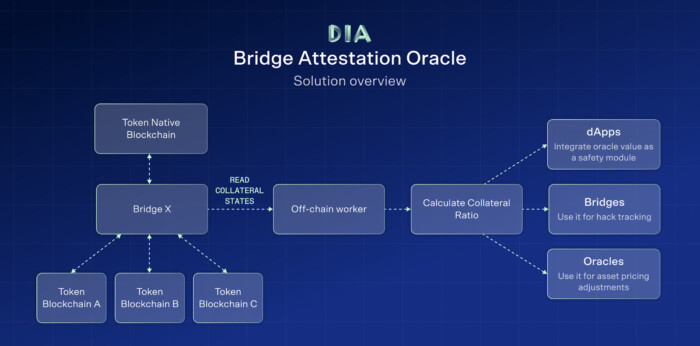

Decentralized Bridge Balance Attestation Oracle for Polkadot

Introduction

DIA’s innovation in Polkadot’s ecosystem introduces a Decentralized Bridge Balance Attestation Oracle. This solution enhances the accuracy and trust in bridge asset management.

Key Features

- Off-chain Worker: Utilizes Polkadot’s native feature for secure, off-chain data aggregation relevant to bridge token balances and issuance.

- Community-driven Bridge Integrations: Features an open-source library enabling adaptable bridge integrations, starting with the Multichain and Interlay bridges.

- Bridge Attestation Oracle: Central to ensuring real-time, accurate collateralization data for bridges, vital for protocol safety mechanisms.

Benefits

This development significantly boosts trust and scalability within Polkadot’s ecosystem, providing crucial, real-time collateralization data for various decentralized applications and enabling proactive safety measures and stakeholder notifications.

For more detailed information, please refer to the DIA’s Decentralized Bridge Balance Attestation Oracle page.

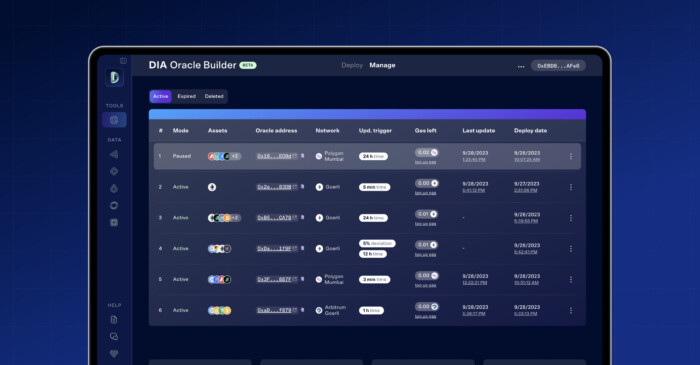

Blockchain Price Oracle Builder

Introduction

The DIA Oracle Builder is a no-code, intuitive tool allowing developers to autonomously create and manage price oracles, tapping into over 2,500 cryptocurrency price feeds.

Key Features

- Instant Autonomous Deployment: Streamlines oracle setup for rapid, automated deployment.

- Customizability: Offers options to select specific price feeds, data sources, and other oracle settings.

- Management Dashboard: A user-friendly interface showing oracle status, update times, and more.

- Monitoring Service: Includes a custom Telegram bot for real-time oracle status updates.

Benefits

This tool significantly streamlines dApp development, reducing oracle setup time to just three minutes and simplifying the process, even for those without smart contract development knowledge. It ensures oracles are tailored to specific dApp needs, enhancing resilience and alignment with data requirements.

For more detailed information, please refer to the DIA Oracle Builder page.

DIA xLSD: Price Oracles for Liquid Staked Derivatives

Concept

DIA xLSD introduces a fair value layer in reporting prices for Liquid Staked Derivatives (LSDs), focusing on collateral ratios rather than market values.

Advancements

- Fair-Value Pricing: Due to the low liquidity of this asset class, this novel approach to determining the fair value of liquid-staked derivatives improves transparency and reduces the risk of market price manipulation.

- DeFi Integration: By providing accurate pricing, DIA xLSD facilitates the integration of liquid-staked derivatives in lending, borrowing, and other DeFi applications.

Impact

This product enhances the utility and security of DeFi protocols by enabling more accurate pricing of liquid-staked derivatives, thereby contributing to the overall safer adoptions of the LSDfi sector.

For more detailed information, please refer to the DIA xLSD page.

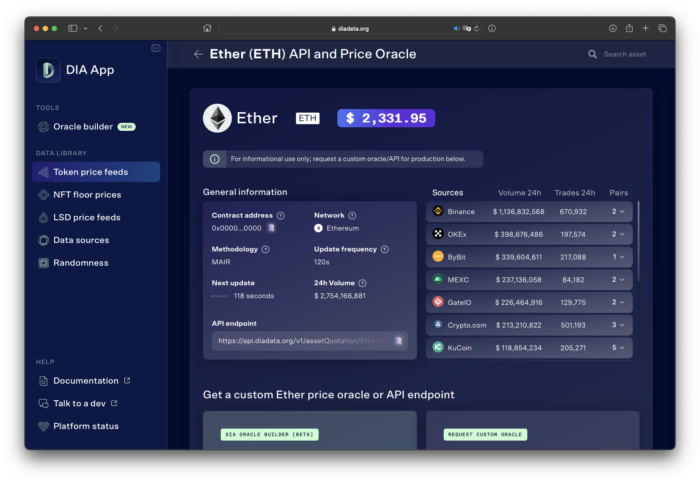

DIA App Upgrade

DIA has recently enhanced its web app with several updates and improvements. A fresh look has been introduced, featuring a new collapsing sidebar and a dropdown menu for more detailed exploration of assets’ data sources. The App homepage has also been revamped.

In terms of improvements, there have been several SEO upgrades to optimize the app’s online visibility. Additionally, more in-app content has been added to enhance user experience, alongside minor bug fixes to ensure smoother app functionality. These changes collectively aim to provide a more intuitive and user-friendly interface for DIA’s web app users.