Powering dApp growth on Astar with DIA oracles

DIA’s oracles have played a key role in driving innovation for dApps on the Astar Network, contributing to its success as a thriving Layer 1.

Introducing: Astar Network

Astar Network is a layer 1 smart contracts parachain in the Polkadot ecosystem. The network supports the building of dApps with EVM and WASM smart contracts and offers developers true interoperability, with cross-consensus messaging (XCM) and cross-virtual machine (XVM). Astar focuses on making the best smart contract platform so that dApp developers on Polkadot do not need to pay much attention to infrastructure and can focus more on the development of their dApp.

The State of Astar Network

The parachain has been gaining popularity across Web2 and Web3. Its strategic approach to capturing the Asian market has helped it secure partnerships with top Japanese Web2 corporations like NTT Docomo, Sony, and Toyota, to launch various hackathons and incubation programs. As a result, the network is expecting to onboard hundreds of new developers onto the network. That might explain why Astar’s native token has seen a significant rally or why Astar CEO Sota Watanabe made it to Forbes Japan’s person of the year.

The Need for Oracle Services on Astar

While at its core, Astar is a smart contracts platform which enables the building and deployment of diverse and innovative dApps, Layer 1 blockchains are inherently limited in their ability to connect dApps to external data, a concept known as the oracle problem.

Due to this limitation, dApps on the Astar Network and other Layer 1 blockchains are dependent on oracles to deliver external data to smart contracts. This oracle data is often essential to the functionality of smart contracts, and many different types of dApps would be unable to function without it.

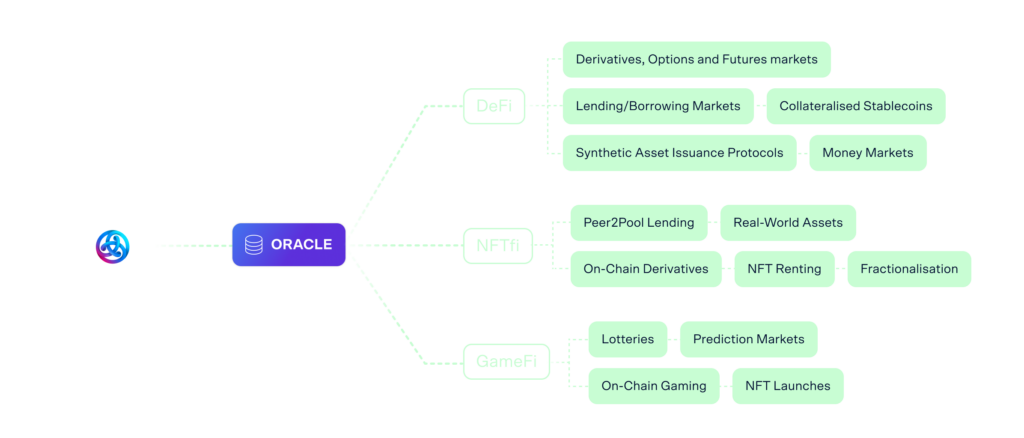

Some examples include lending protocols, money markets, synthetic assets issuers, derivatives, options and futures markets, randomness-consuming apps and many more.

Web3 use cases enabled by blockchain Oracles

The Solution: DIA’s Oracle Suite

DIA is a multi-chain oracle provider that enhances data transparency, customisation, and accessibility. With a unique architecture that aggregates raw trade data directly from 80+ sources, such as centralized and decentralized exchanges, DIA offers 100% source transparency and bespoke customization.

To help Astar unlock its full potential and expand the number of deployable applications on the network, DIA integrated its oracle services on Astar, available in EVM and WASM environments.

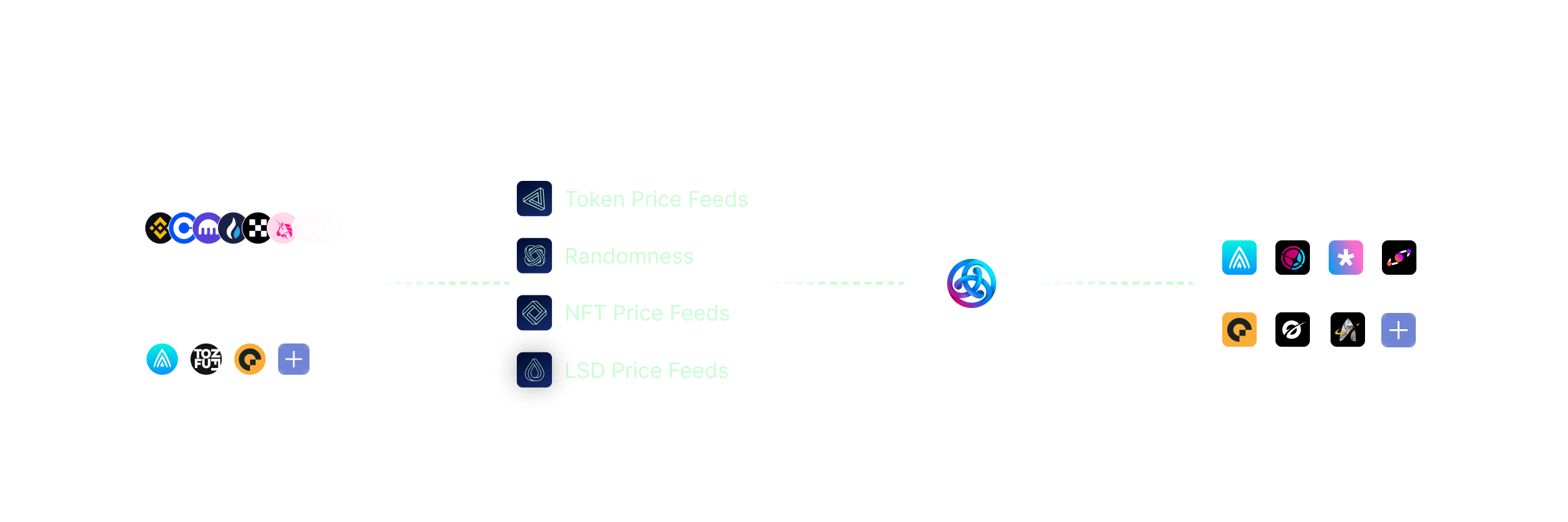

Comprehensive Product Stack

From Price Feeds, Random Number Generation to on/off-chain automation, DIA’s product offerings cover all oracle needs a Web3 application might require. Moreover, DIA allows the creation of price feeds for over 3,000+ crypto assets, 18,000+ NFT collections, 20,000+ traditional assets, Liquid Staked Derivatives and more, with the ability to customize each feed for specific protocols and use cases.

The Broadest Data Library in Web3

In order to obtain such a wide array of data feeds, DIA employs a process of scraping trade data directly from both CEXs and DEXs, at an individual trade level. This approach allows DIA to leverage the most comprehensive set of sources available, thereby ensuring the highest possible coverage of price data while providing 100% data transparency.

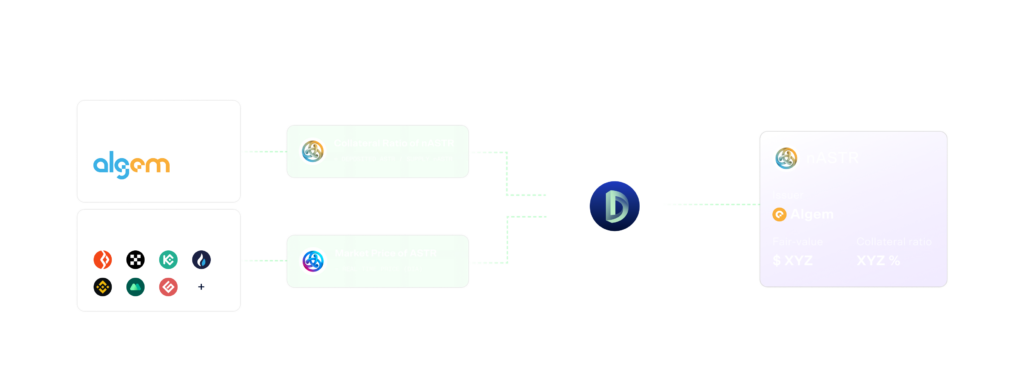

Inter-Connecting Astar Native Assets

Given that many projects operate exclusively on specific blockchain networks and their assets are only traded on chain-native DEXs, DIA precisely sources data for those assets.

Native Data Journey for the Astar Ecosystem

To support the growth of Astar, DIA has developed scrapers that are able to obtain asset data from Astar’s native exchanges.

DEXs like Arthswap | LSD issuers like Algem | NFT marketplaces like TofuNFT

As a result, besides providing regular price oracles for blue-chip and long-tail tokens, DIA is building price oracles for Astar native assets as well as extending their reach across 33 chains through the provision of inter-ecosystem price feeds. This allows any dApp in any chain to ingest these price feeds, enabling the listing of the tokens in DeFi protocols and allowing the token’s further utilisation and utility.

These unique features expand the utility and usage of Astar-native tokens, contributing to Astar’s success as a thriving Layer 1 blockchain ecosystem that is shaping the future of multi-chain technology.

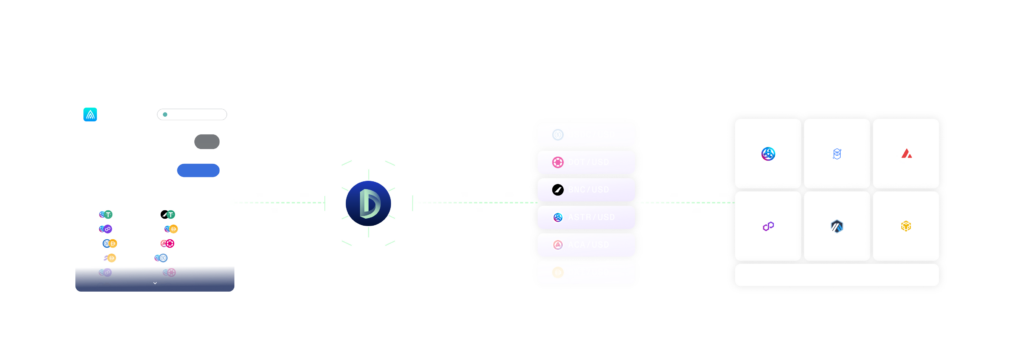

Empowering dApp Growth on Astar Network

DIA’s bespoke and dedicated oracles have enabled the production of a diverse mix of innovative dApp categories on the Astar Network, including DeFi, NFT-Finance, Liquid Staking, DEX, and Verifiable Randomness.

1. Decentralised Finance — DeFi

DIA has partnered with leading dApps including AstridDAO, Starlay Finance, SiO2 Finance, and Orcus Finance, providing the backbone for a range of DeFi solutions including Collateralized Debt Providers, Lending & Borrowing Markets, and Algorithmic Stablecoins.

Launch of Starlay with DIA Price Oracles

2. NFT Finance–NFTfi

DIA has teamed up with dApps such as Starfish Finance to provide robust NFT floor price feeds, thereby enabling the Starfish Finance peer-to-pool NFT finance model. DIA’s NFT Floor price feeds support over 18,000 collections from the top NFT marketplaces in the industry, including Astar-native NFT collections on TofuNFT.

Transparent, Customisable NFT Price Feeds

3. Liquid Staking Derivatives — LSDs

DIA’s cutting-edge fair-value pricing methodology enables the creation of oracle price feeds for Liquid Staking Derivatives, with transparent, collateral-proofed data. This enables the boosting of the prospects for use cases and capital efficiency through protocols such as Algem.

Collateral-Proofed Liquid Staked Derivatives

4. Decentralised Exchanges–DEXs

DIA’s innovative architecture empowers the direct sourcing of trade data from Astar-native Decentralized Exchanges (DEX), such as Arthswap. This allows DIA to generate price oracles for Astar-native assets as well as extend their reach across 33 chains through the provision of inter-ecosystem price feeds.

Network-Native Token Price Sourcing

5. On-Chain Verifiable Randomness–VRF

Following a community governance proposal, DIA’s on-chain verifiable randomness oracle has been funded by the Astar treasury and designated as the official random number generator of the Astar ecosystem, catalyzing innovation in GameFi, to power prediction markets, lotteries, NFT drops, and other dApps which require random number generation on-chain.

Verifiable, Distributed Randomness On-Chain

"DIA was the first oracle on our canary network Shiden and on our mainnet, Astar. DIA gave great support to us and projects that are building in our ecosystem and looking for a trusted oracle. At the Astar ecosystem, we offer our developers the best dApp platform inside the Polkadot ecosystem with the best tooling and integrations. DIA is one of those integrations we promote highly amongst our developer community."Maarten Henskens

VP of Growth of Astar Network

Looking to fuel the growth of your L1/L2 ecosystem?

Contact the DIA team to explore how our dedicated and custom solutions can drive innovation and bring new growth opportunities to your ecosystem.